Texas State Unemployment Tax Rate 2025 - Texas residents state income tax tables for married (separate) filers in 2025 personal income tax rates and thresholds (annual) tax rate taxable income threshold; Real gross domestic product gdp growth in the fourth.

Texas residents state income tax tables for married (separate) filers in 2025 personal income tax rates and thresholds (annual) tax rate taxable income threshold;

Texas State Unemployment Tax Rate 2025. Criminal charges to the employer. Graph and download economic data for.

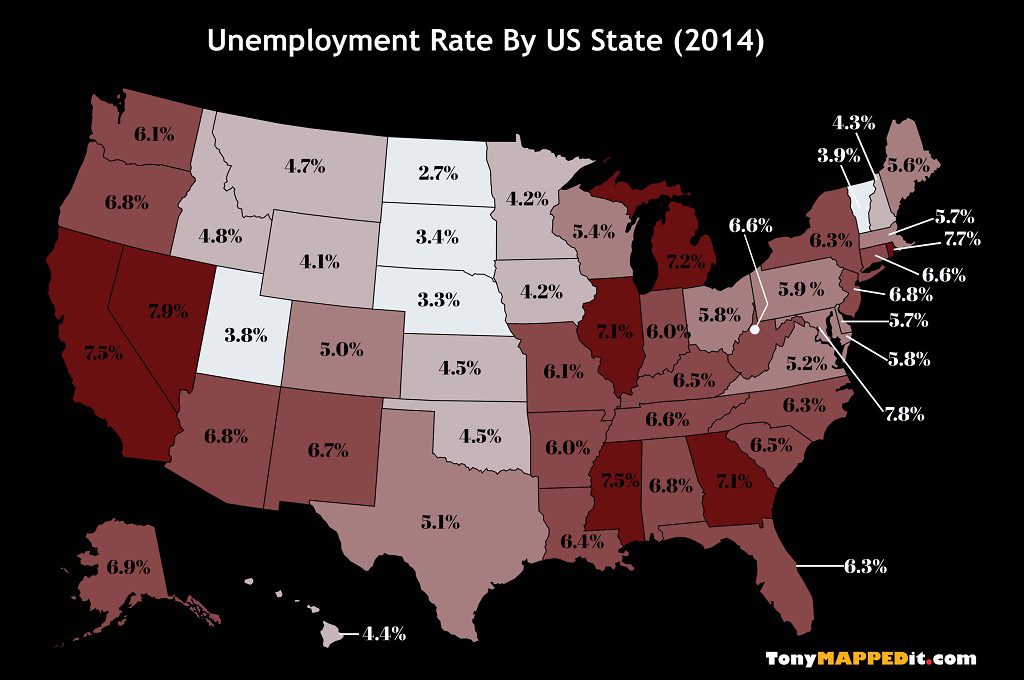

The Unemployment Rate in U.S. States from 1980 to September 2025, Your taxable wages are the sum of the wages. Employment grew faster than in october, while.

Texas Unemployment Calculator (2025) Unemployment Portal, If you make $70,000 a year living in texas you will be taxed. State labor department releases preliminary january 2025.

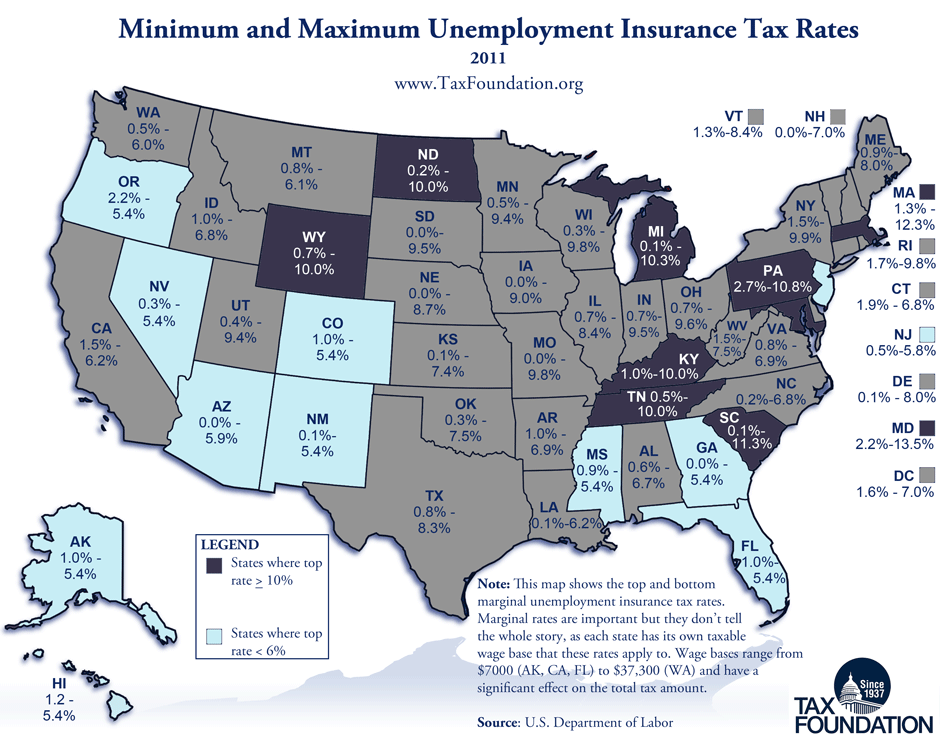

Monday Map Unemployment Insurance Tax Rates Tax Foundation, Tax rates for 2023 range from 0.23% to 6.23%. State labor department releases preliminary january 2025.

Tax rates for the 2025 year of assessment Just One Lap, Most of the filing requirements for texas employers may be accomplished online. Your taxable wages are the sum of the wages.

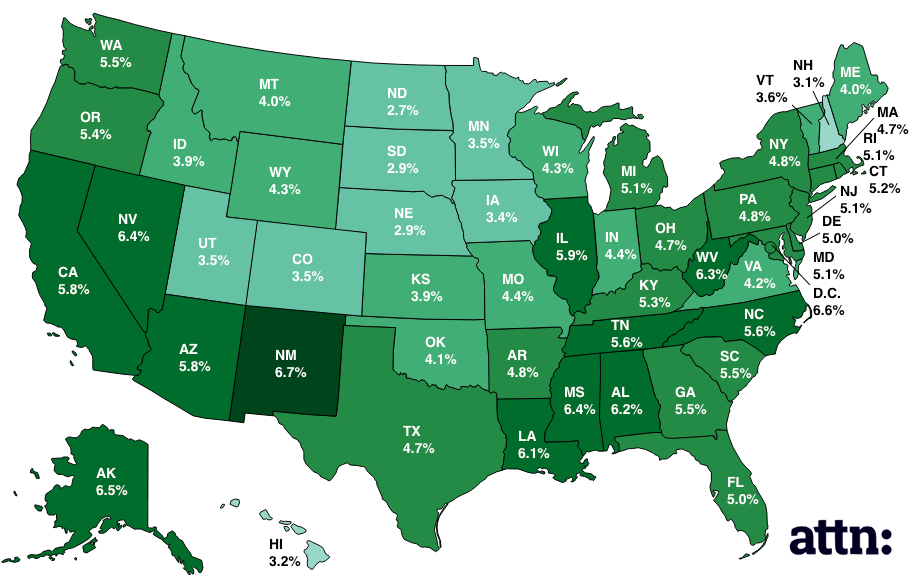

Here's every US state's unemployment rate AOL Finance, Advances to state unemployment funds ². Irs direct file pilot states.

An updated chart of state taxable wage bases for 2025 to 2025 (as of february 7, 2025) may be.

What Is My State Unemployment Tax Rate? 2023 Rates by State, State unemployment insurance taxable wage bases for 2025. Your taxable wages are the sum of the wages.

Unemployment Rate By US State From 2025 To 2025 Tony Mapped It, Your effective unemployment insurance (ui) tax rate is the sum of five components described below. The state unemployment tax act is a tax that states use to fund unemployment benefits.

State labor department releases preliminary january 2025.